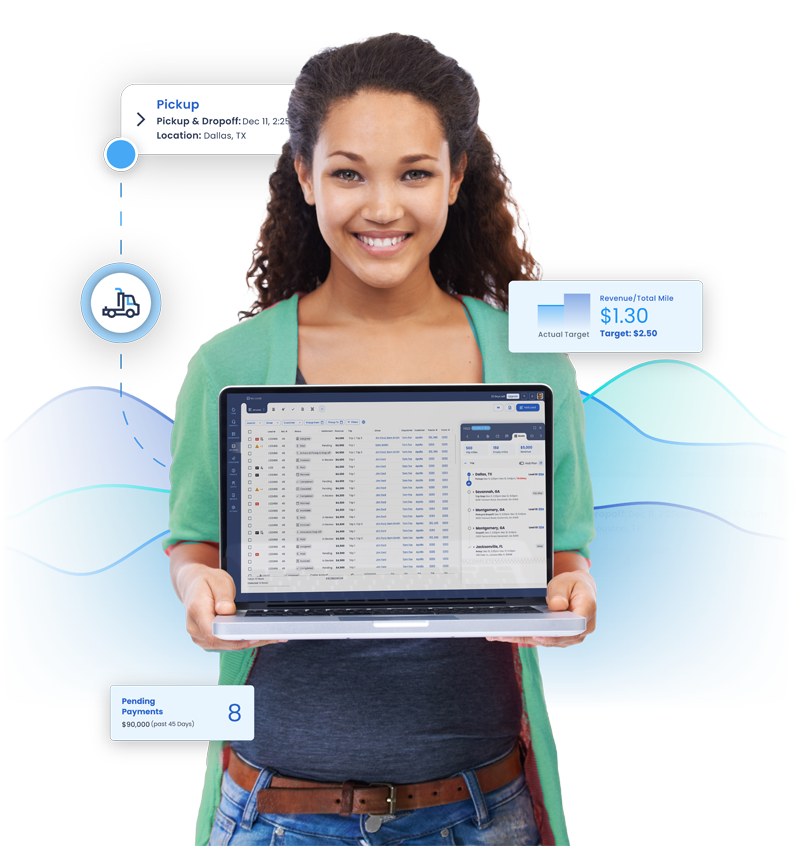

Simplify Dispatch

Sync your operations

Share, sign and capture documents from driver app to speed up your delivery process for quicker payment. Quickly access important documents all in one place

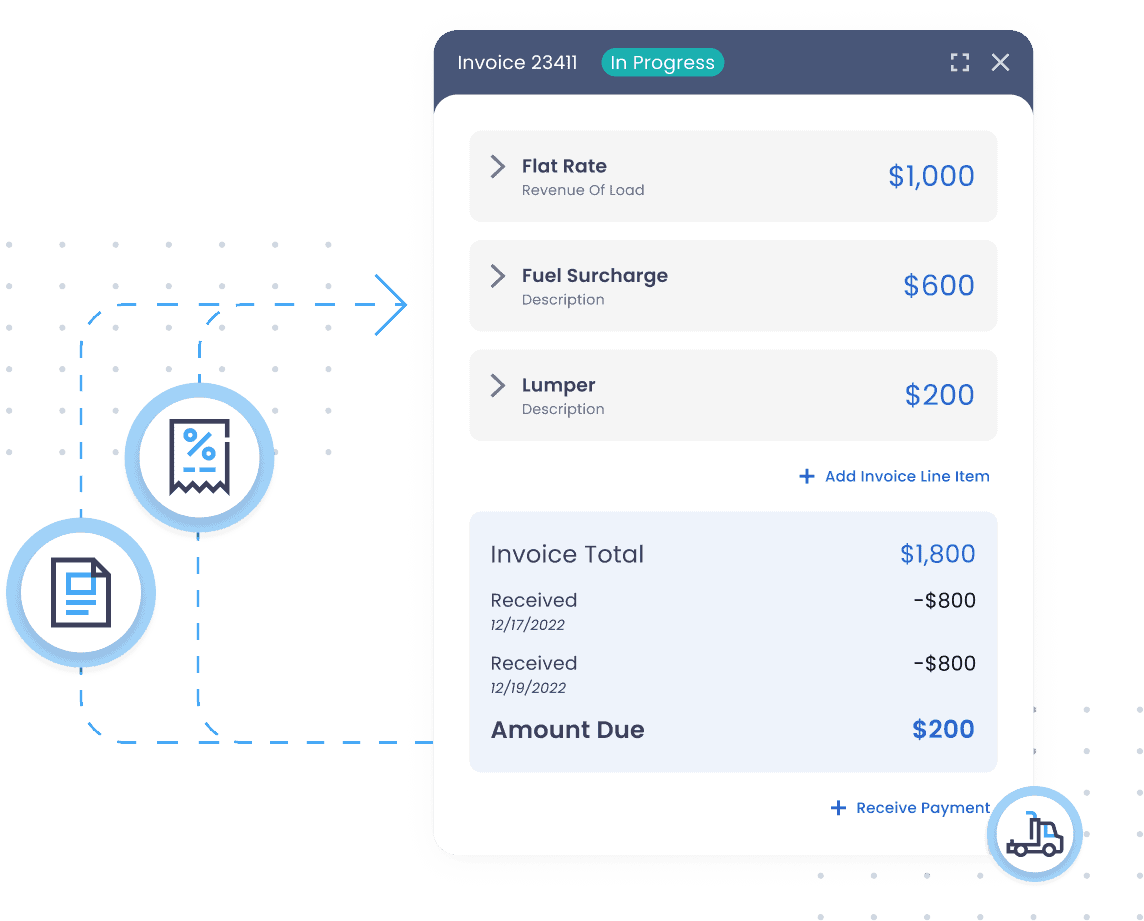

Get paid faster

Improve cash flow and save time by instantly sending invoice details and supporting documents for factoring [ Apex, TAFS, Triumph and OTR Solutions]

Stay In The Loop With Drivers

Share loads with drivers, stay up-to-date on their position and status, and keep them informed on payments.

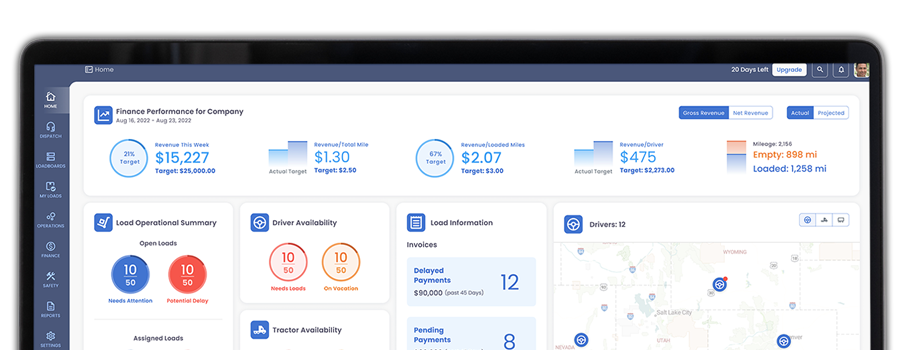

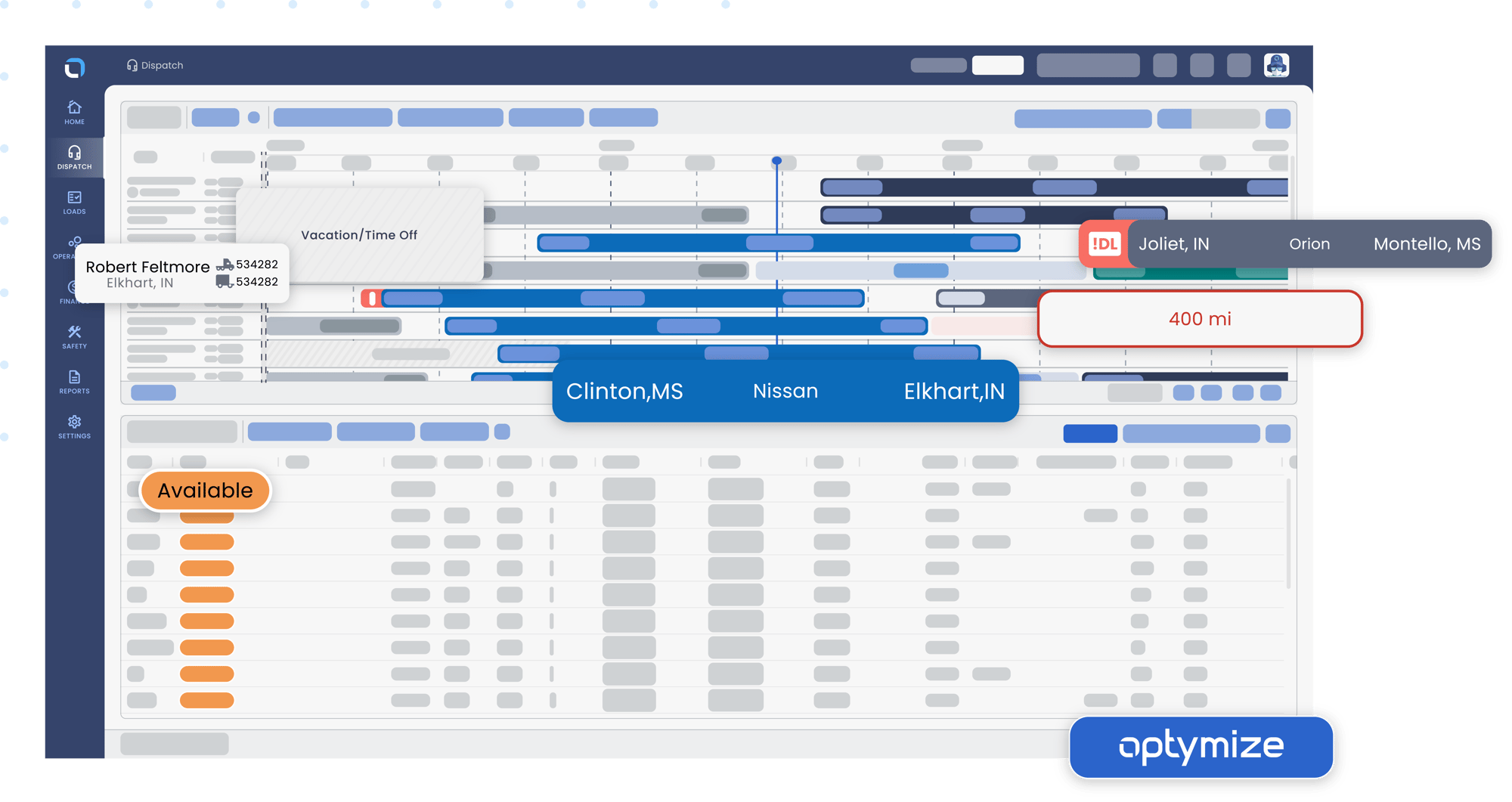

Dispatching made easy, for real

See driver schedules, statuses, time off, gaps, locations, and more—all from a single page.

See driver utilization and availability and easily identify gaps and assignment opportunities.

Surf all the loadboards

Connect with load boards—like DAT, 123Loadboard, truckstop.com, and C.H. Robinson—to find the most profitable loads for each driver.

Get paid faster

From paperwork to payment, what used to take weeks now takes just 15 minutes. Empower your drivers to upload documents, prepare invoices, and send directly to customers and factoring services—efficiency delivered.

Stay in the loop with drivers

Share loads with drivers, stay up-to-date on their position and status, and keep them informed on payments.